The Proxy Market Research Report is one of the best tools for gauging the industry’s health, the providers’ performance, and possible future trends. In the 2024 edition, the team of researchers compares and contrasts the offerings of 13 major proxy server providers, including large-, medium-, and smaller-scale companies.

Infatica, with its commitment to innovation and customer-centric approach, has been featured prominently in this year's edition. The report highlights Infatica's significant improvements of its proxy products, including important criteria like response time, success rate, and IP address pool growth. Let’s take a closer look at these changes – and general industry trends:

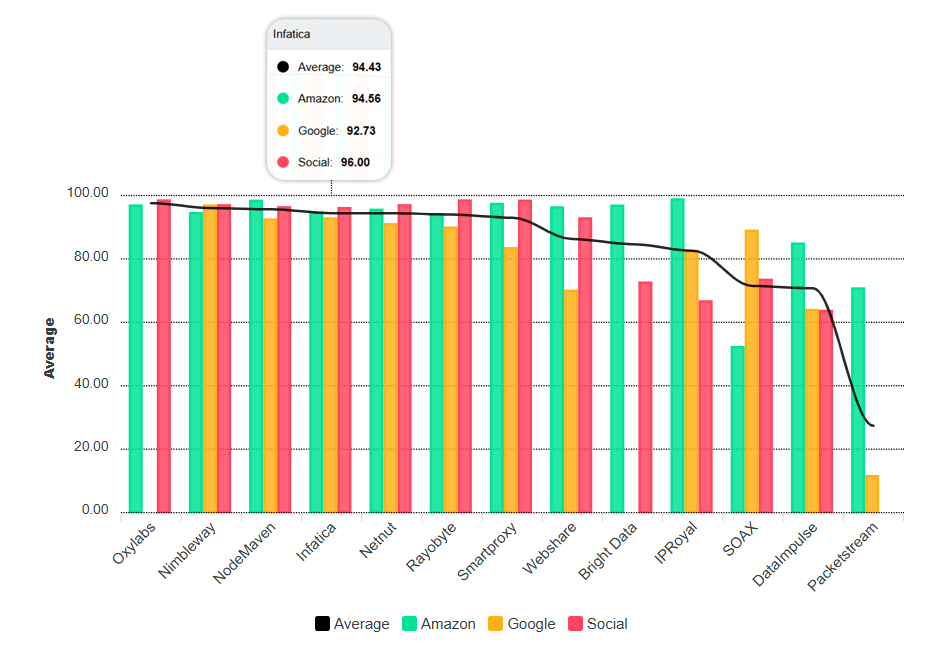

Infatica’s average success rate with major websites

The success rate with major websites like Amazon, Google, and social media platforms is an indicator of a proxy service's reliability and effectiveness. A high success rate means that proxy users can consistently access these websites without encountering blocks or failures. This is crucial for businesses that rely on proxies for web scraping, SEO monitoring, and ad verification, where uninterrupted access to data is necessary for accurate analytics and decision-making.

Infatica's impressive success rate – 94.4% – reflects its ability to navigate anti-scraping measures, ensuring that clients have the data they need when they need it.

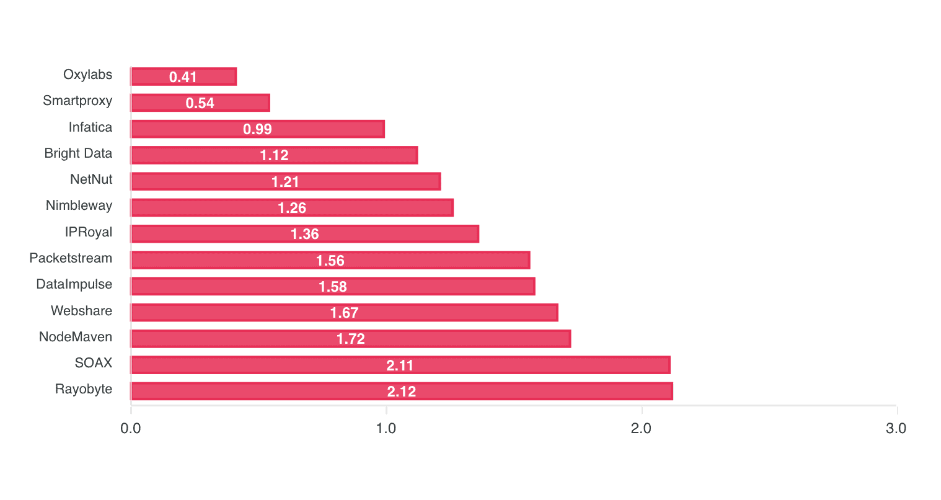

Infatica’s infrastructure response time

The response time of a proxy infrastructure is a critical metric that determines the speed at which data travels between the user and the internet services they are accessing. In the context of proxies, lower latency translates to faster access to web resources, which is particularly important for time-sensitive applications such as market data analysis, competitive intelligence, and high-frequency trading.

Infatica boasts great performance in this category, with an average response time of 0.99 seconds.

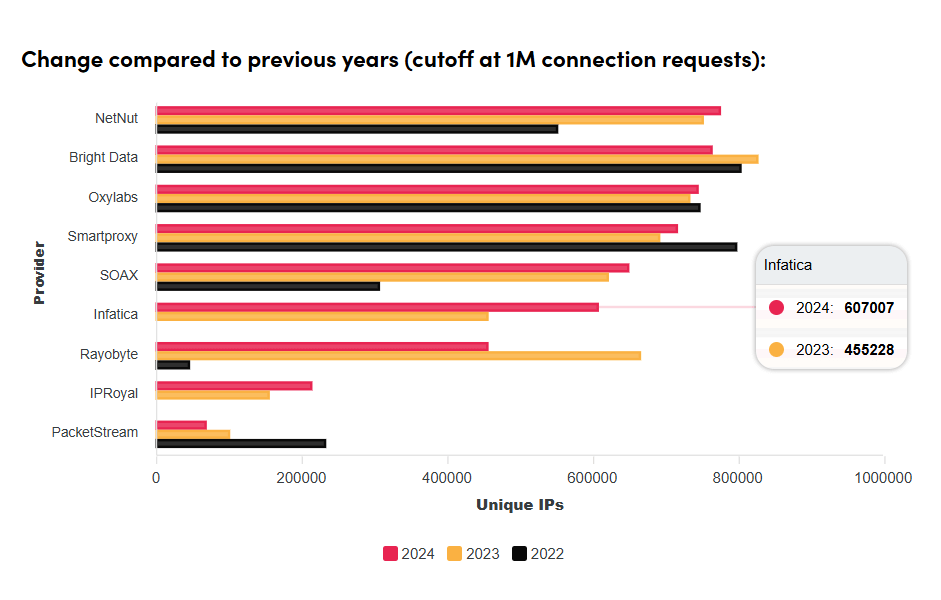

Infatica’s IP pool increase

A larger IP pool size equates to a more diverse and robust connectivity framework. It allows for a greater number of unique IP addresses to be available for tasks that require frequent IP changes, such as large-scale data crawling or avoiding detection by target websites. This diversity ensures that requests appear to come from different users, enhancing the ability to access data without triggering anti-scraping defenses.

With the one million connection requests as the cutoff point, the researchers report a 33% increase in the IP pool size for Infatica – one of biggest changes out of 13 providers analyzed.

Proxy industry trends and findings

The 2024 edition of the Proxy Market Research also encapsulates industry news, usage trends, and a multi-year analysis. Here are two factors that influence this industry the most:

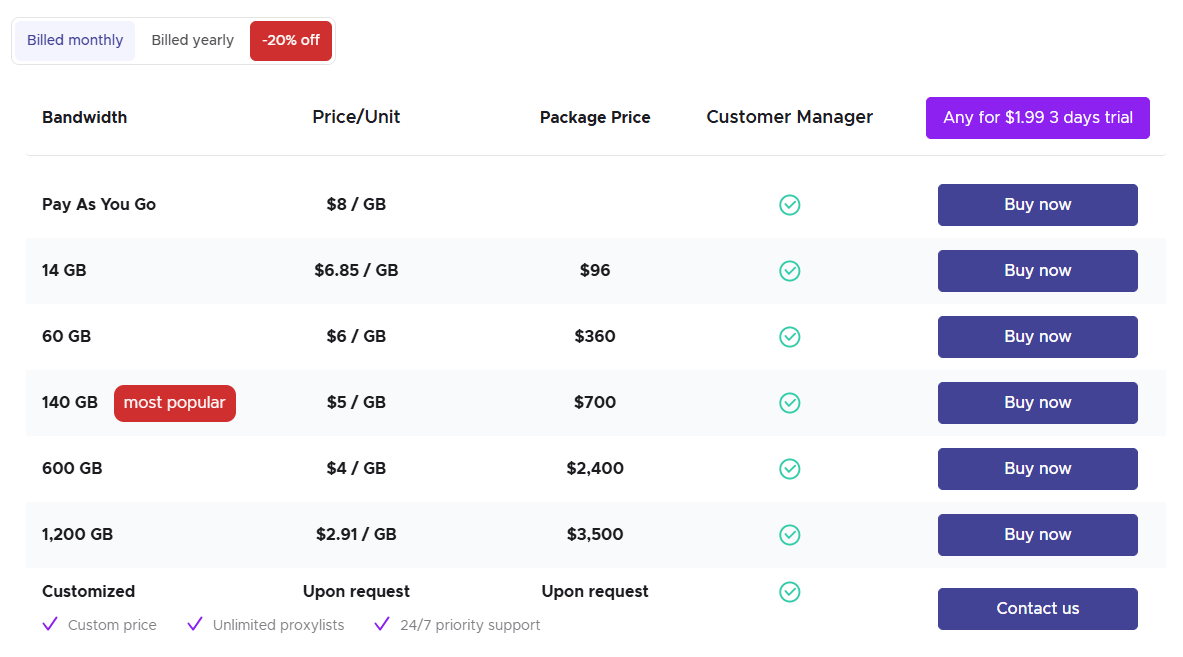

Price decrease across all proxy products

The proxy market has witnessed a notable trend of price reductions among various providers since 2023. Several factors may be at play here:

Intensified competition in the proxy services sector: As the market expands, companies are compelled to offer more competitive pricing to attract and retain customers. This is particularly true for businesses that rely heavily on web scraping, data analytics, and machine learning, where proxies are indispensable tools. The increased demand for these services has led to a surge in the number of proxy providers, which in turn has driven prices down as they compete on cost-efficiency.

More efficient proxy network infrastructures have reduced operational costs for providers. These savings are often passed on to the consumers in the form of lower prices.

The report also highlights that several providers have introduced “micropackages”, providing an affordable option for interested users to sample their products. For example, you can sign up for Infatica’s 3-day trial for just $1.99.

A new monetization model, pay-as-you-go, is serving as an alternative to the traditional subscription. Compared to the previous year, more proxy providers, including Infatica, are offering this option to their customers:

Proxy industry growth

The significant revenue increase and company growth reported by many proxy providers in 2023-2024 can be seen as a reflection of the industry's overall health and the growing importance of proxy services in the digital economy.

The proxy industry has experienced a surge in demand due to the increasing need for data privacy, secure browsing, and access to geo-restricted content. This has been further amplified by the rise of remote work, which has led to a greater need for secure and private internet access. Additionally, the expansion of data-driven decision-making across various sectors has necessitated the use of proxies for web scraping and data collection, contributing to the industry's growth.

The growth in revenue also indicates that providers are successfully scaling their operations and optimizing their services to meet the evolving demands of the market. Infatica, for instance, reports 60% more revenue – and is projecting to double its revenue in 2024.