Competitor price tracking has become a cornerstone of modern pricing strategy, helping businesses stay aligned with fast-moving markets and ever-changing customer expectations. With competitors adjusting prices, promotions, and stock levels in real time, relying on occasional manual checks is no longer enough. To make confident, data-driven decisions, companies need continuous access to accurate, structured pricing data – and automated collection tools like Web Scraper APIs make this possible at scale.

Key Business Benefits of Competitor Price Tracking

Effective competitor price tracking gives businesses a sharper understanding of their market position and lets them make pricing decisions with far greater confidence. By continuously monitoring how competitors adjust their prices, promotions, and stock levels, companies can detect trends early and act before those changes impact revenue. This helps brands react not just faster but smarter – aligning pricing with real-world demand, protecting profit margins, and maintaining customer trust.

Price tracking also reveals hidden opportunities: underpriced SKUs that could safely be increased, overpriced items that may be losing to competitors, and gaps in product assortments. For ecommerce teams, up-to-date competitor data improves promotional planning, reduces race-to-the-bottom discounting, and supports automated repricing strategies. Across all industries, the biggest advantage is clarity: knowing exactly where you stand in the market at any moment.

What Data You Need for Effective Price Tracking

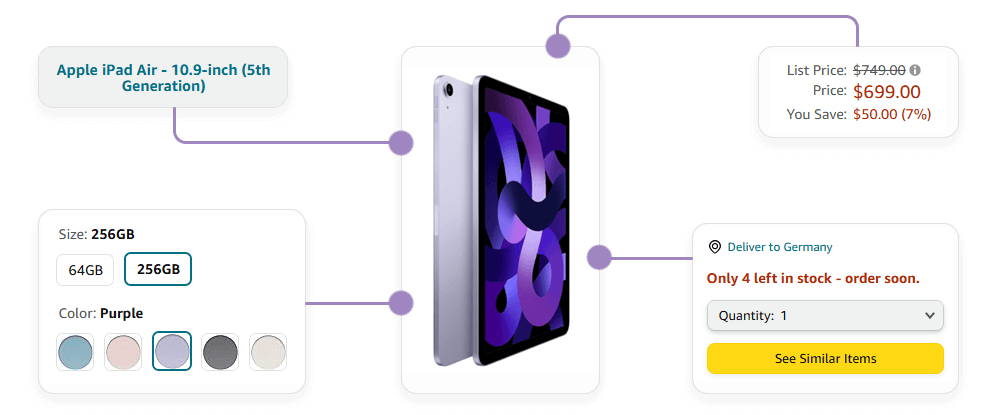

Reliable competitor price tracking depends on gathering the right mix of product, pricing, and availability data – and doing so consistently. The goal isn’t just to compare numbers but to understand the full pricing context around each product. To achieve this, businesses typically need several categories of information:

Product prices

Base prices, sale prices, and discounts applied at checkout. Tracking these across multiple competitors reveals both immediate differences and long-term pricing patterns.

Stock availability

Whether an item is in stock, low-stock, or out of stock directly affects pricing decisions. Competitors frequently adjust prices based on inventory, making availability a key signal.

Promotions and discounts

Special offers, coupon codes, bundle deals, and seasonal sales can make a product appear cheaper than its base price. Ignoring these can distort comparisons.

Regional pricing and shipping details

The same item can cost different amounts depending on location, shipping fees, taxes, or marketplace-specific adjustments. For global or multi-region sellers, this is critical.

Marketplace vs. retailer variation

Marketplaces (Amazon, eBay) might display multiple seller prices for the same SKU. Tracking these variations helps brands understand how their products are being represented.

Historical price changes

Past pricing trends help teams identify seasonality, competitor strategies, and potential repricing triggers.

How Competitor Price Tracking Works: Technical Overview

Competitor price tracking is a structured, repeatable workflow that combines targeted data collection with automated processing. While the specific setup differs for each business, most teams follow a similar sequence:

1. Identify target websites and product pages

Start by listing the competitors, marketplaces, and specific product URLs you want to track. This includes direct rivals, third-party sellers, and region-specific storefronts. Defining clear targets makes the rest of the workflow predictable and scalable.

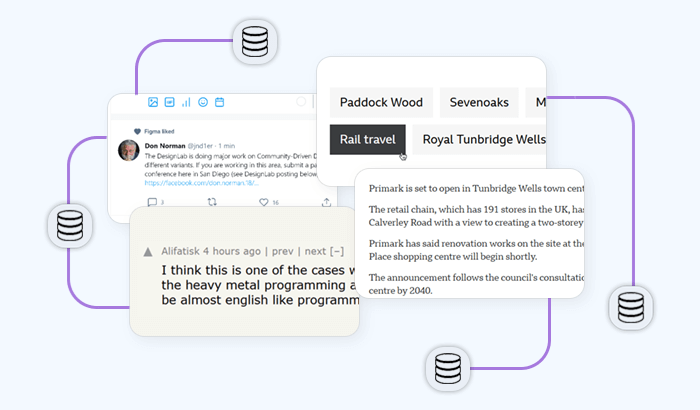

2. Extract product and pricing data at scale

Automated systems – often built around scraping frameworks or Web Scraper APIs – request the relevant pages and collect information such as prices, stock indicators, promotions, and shipping details.

3. Normalize and match products

Different websites may use unique naming conventions or identifiers. Matching items across competitors requires normalization using attributes like SKU, GTIN/UPC, MPN, brand, or product titles. Clean, structured fields are essential for consistent comparison.

4. Compare prices across competitors

Once aligned, products can be compared on base price, discounted price, shipping cost, and availability. This step typically feeds into dashboards or automated triggers that highlight opportunities or risks.

5. Configure alerts and repricing triggers

Many organizations set rules such as “alert when competitor price drops by X%” or “raise price when all major competitors go out of stock.” These event-based rules enable near-real-time strategic reactions.

6. Feed insights into pricing tools or BI systems

The final data is stored, visualized, and often automated within pricing engines, internal dashboards, forecasting tools, or machine-learning-based models.

Common Challenges Teams Face

Because of these hurdles, many organizations eventually shift from in-house scrapers to managed Web Scraper APIs that automatically handle IP rotation, browser rendering, error retries, and structured data output. This reduces maintenance overhead and ensures that competitor price tracking systems remain stable, accurate, and scalable over time.

Anti-bot systems and IP blocks

Retailers deploy rate limits, CAPTCHAs, and bot-detection tools that can break scrapers or distort results. Without rotating IPs, proper headers, or automated retries, data pipelines become unreliable.

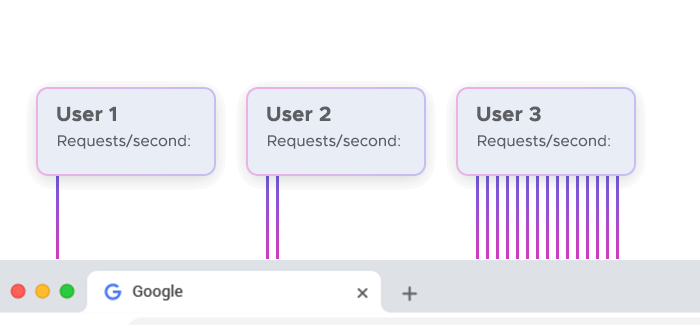

Scaling from hundreds to millions of SKUs

What works for a small product list often collapses when expanded. Large-scale tracking requires distributed crawling, stable infrastructure, and consistent performance under heavy load.

Dynamic and JavaScript-heavy websites

Many ecommerce sites render key pricing elements client-side. Scrapers that rely on simple HTTP requests often miss critical information unless they use headless browsers or APIs capable of executing JavaScript.

Frequency and freshness limits

If competitor data isn’t updated at the right intervals, insights lose value. High-frequency tracking can also trigger more blocks, increasing infrastructure complexity.

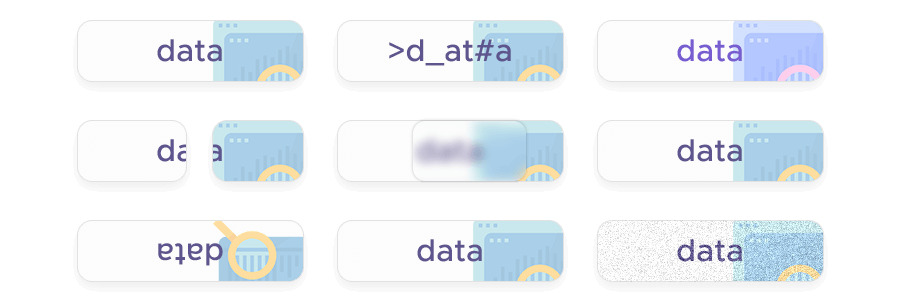

Data quality, consistency, and product matching

Incomplete fields, missing prices, inconsistent naming, or mismatched SKUs can introduce noise – resulting in misleading comparisons. Ongoing validation and normalization are essential.

Use Cases & Industry Examples

Competitor price tracking is a critical capability across multiple industries, each with its own pricing dynamics and competitive pressures. While the specific tactics differ by sector, the underlying value is the same: timely, accurate data enables smarter decisions and sharper positioning.

E-commerce and Retail

Online retailers operate in constantly shifting markets where price changes can occur multiple times per day. Competitor tracking helps them:

- Adjust prices dynamically

- Detect promotional campaigns

- Prevent margin erosion

- Optimize cross-selling and bundling strategies

High-frequency tracking – supported by automated scraping tools – keeps retailers aligned with market movements at all times.

Consumer Electronics

Electronics pricing is volatile and highly competitive. Retailers and brands use price tracking to:

- Monitor the impact of new product launches

- Compare prices across dozens of sellers

- Detect sudden price drops and undercutting

- Align with marketplace trends

Since many electronics product pages rely on JavaScript-heavy content, reliable rendering and structured data extraction are essential.

Travel and Hospitality

Airlines, hotels, OTAs, and aggregators rely heavily on competitor pricing as demand fluctuates hourly. Use cases include:

- Tracking room rates across regions

- Monitoring airfare changes

- Benchmarking fees, taxes, and surcharges

- Identifying opportunities for flash sales

Here, regional pricing and multi-currency support become critical components of the tracking pipeline.

Marketplaces and Multiseller Platforms

Marketplaces like Amazon, eBay, and Etsy often feature multiple sellers for the same SKU. Price tracking helps brands and sellers:

- Enforce MAP (minimum advertised price) policies

- Detect unauthorized discounting

- Identify grey-market listings

- Ensure consistent brand representation

Accurate product matching and seller-level monitoring are vital for these use cases.

Brands Monitoring Resellers

Manufacturers and distributors use competitor price tracking to maintain channel health. Key objectives include:

- Ensuring compliance with pricing agreements

- Protecting premium brand positioning

- Detecting inconsistent or suspicious pricing behavior

- Preventing channel conflict

Automated monitoring helps maintain transparency and strengthens relationships with authorized partners.