- The Importance Of Price Analysis

- Methodology

- Finding: Geo-Location Impacts Price – Even on the Same Platform

- Finding: Some Platforms Consistently Offer Better Deals – But Not Always

- Finding: Direct Hotel Websites Sometimes Show Different – Or Inaccessible – Offers Compared to Aggregators

- Finding: Hotels Lose Visibility – And Potential Guests – If Platforms Don’t Offer Listings for Certain Regions

- How Infatica Powers Accurate, Scalable Data Collection

- Frequently Asked Questions

When it comes to hotel bookings, pricing can change dramatically based on where you are and which platform you use. In this report, we explore how location and platform choice can impact hotel prices – using real-world data collected from popular Barcelona hotels. We also demonstrate how scalable, compliant data collection, powered by Infatica’s proxy infrastructure, enables deeper pricing insights that are essential for hotel chains, OTAs, and market intelligence teams.

The Importance Of Price Analysis

In today’s highly competitive hospitality industry, real-time pricing intelligence isn’t just a strategic advantage – it’s a necessity. Room prices no longer stay static; they fluctuate constantly based on market demand, geolocation, inventory availability, special events, and even a customer's browsing history. For hotel chains and online travel agencies (OTAs), tracking these shifts across multiple platforms and regions is vital for staying competitive and maximizing revenue.

Without visibility into how room rates vary by platform, location, or time of day, hotels risk losing bookings to competitors, misaligning their revenue management strategies, or falling victim to price undercutting by third-party sellers.

Geographic price variation can reveal important opportunities – such as regions where prices can be optimized upward – or risks, like underpriced rooms diluting brand value in key markets. Monitoring how different platforms (direct booking sites, OTAs, meta-search engines) display rates can also expose unauthorized resellers or pricing inconsistencies that impact customer trust and conversion rates.

Yet collecting this data manually is nearly impossible at scale:

- Results are inconsistent between users and locations.

- Websites are increasingly sophisticated at blocking scraping attempts.

- Manual tracking quickly becomes too slow to keep up with fast-moving pricing dynamics.

Methodology

To explore how hotel room prices vary across platforms and geographies, we conducted a targeted data collection project focused on popular Barcelona hotels and leading booking platforms.

Hotels Selected

We focused on major hotel brands and business-class properties that are representative of the global hospitality market. The hotels included in this study are:

- Hilton Barcelona

- Ibis Barcelona Meridiana

- NH Collection Barcelona Gran Hotel Calderón

- Eurostars Grand Marina Hotel

- Hotel Arts Barcelona (Ritz-Carlton Group)

- Melia Barcelona Sarrià

- Room Mate Anna

- H10 Cubik

- AC Hotel Barcelona Forum (Marriott)

- Leonardo Hotel Barcelona Las Ramblas

These hotels were selected based on brand recognition, geographic diversity within Barcelona, and accessibility via major online travel agencies (OTAs) and direct booking platforms.

Platforms Monitored

We tested pricing on a range of popular booking channels to capture potential variation between direct and third-party sales:

- Hotel official websites (direct booking)

- Booking.com

- Expedia

- Agoda

Geolocations Simulated

To observe how prices may change based on user location, we simulated browsing from the following regions:

- Germany (Europe – Central Region)

- United States (North America – East Coast)

- Israel (Middle East – Western Asia)

- Japan (East Asia – Pacific Region)

We used a combination of proxies and Tor browser technologies to simulate local access as realistically as possible, minimizing any potential bias or detection by the platforms.

Scraping Setup and Data Quality

Because this project prioritized data quality and consistency, we opted for geolocation switching and secure browser environments. Key points of our setup:

- All searches were conducted during a controlled time window to minimize dynamic pricing shifts.

- Caches, cookies, and browser fingerprints were cleared between sessions to avoid personalized pricing influences.

- For each hotel-platform-geo combination, we collected price information for a standard single room for a one-night stay, ensuring comparability across results.

- If promotional offers or loyalty discounts appeared, we recorded only the standard listed price.

By focusing on careful session control and source diversity, we ensured the collected data reflects realistic price differences without contamination from personal browsing history, loyalty programs, or algorithmic bias.

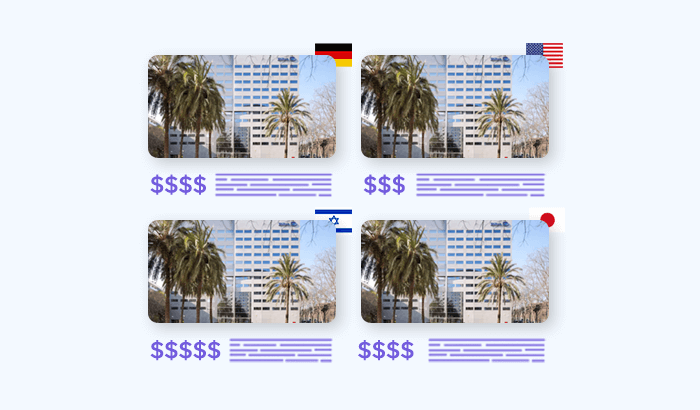

Finding: Geo-Location Impacts Price – Even on the Same Platform

What we observed: When checking prices for the same hotel on the same platform, small variations of €1–€2 depending on the simulated user location (Germany, US, Israel, Japan) appeared consistently. For example, a room at Hilton Barcelona on Booking.com was priced at €226 from Germany, €228 from the US, and €227 from Israel.

Why this matters: Even slight differences show that hotel platforms dynamically adjust their pricing based on where a user is browsing from. This can have major implications for global hotel chains and online travel agencies (OTAs) – because it means price consistency isn't guaranteed internationally.

Why this may happen:

- Regional pricing strategies: Platforms may adjust prices to match local market expectations, purchasing power, or competitive landscapes.

- Currency exchange buffers: Even when displaying prices in euros, platforms might apply slight "rounding" differences when converting from other currencies internally.

- Localized promotions: Some special deals, discounts, or fees may apply only for users in specific countries or regions.

- Risk mitigation: Platforms might set slightly higher prices for users from regions perceived to have a lower likelihood of booking, to cover operational risks.

- Testing and personalization: Some platforms A/B test different prices across regions to optimize their revenue strategies.

What it means for hotels and OTAs: Understanding and managing these geo-based price differences is important to ensure fair pricing, maintain brand trust, and avoid situations where customers feel penalized based on their location.

Finding: Some Platforms Consistently Offer Better Deals – But Not Always

What we observed: Across our sample, certain platforms tended to show slightly lower average prices compared to others. For instance, Check24 often listed lower room rates than Booking.com or Hotels.com for the same hotels. However, this wasn’t universal: for a few hotels, Check24 was actually more expensive, and in some cases, there was no price difference at all.

Why this matters: This inconsistency shows that travelers who assume one platform is always cheaper may be missing out on better deals elsewhere. For hotels and OTAs, it highlights the importance of monitoring how their inventory is priced across multiple channels – because discrepancies can directly influence customer booking behavior and brand perception.

Why this may happen:

- Different commission structures: Platforms negotiate varying commission rates with hotels, and these differences can influence the final listed price.

- Platform-specific promotions: Some platforms offer exclusive discounts, flash sales, or loyalty member benefits that affect the displayed price.

- Update frequency: Platforms may update their inventory and prices at different times, creating temporary mismatches between sites.

- Bundled fees: Some platforms might include hidden charges (like service fees or taxes) in different ways, making it seem like prices differ more than they actually do.

What it means for hotels and OTAs: Hotels and OTAs need to actively track how their rates appear across all major platforms to ensure rate parity (or to manage intentional deviations). Discrepancies that aren't strategically controlled could confuse customers, dilute the brand image, or erode direct booking advantages.

Finding: Direct Hotel Websites Sometimes Show Different – Or Inaccessible – Offers Compared to Aggregators

What we observed: In several cases, the hotel's own website displayed room options or prices that were different from what appeared on aggregator platforms like Booking.com, Expedia, or Agoda. Even when aggregators listed the hotel, they sometimes didn’t show the same room categories, availability, or special rates that were visible when booking directly. In a few cases, rooms available on the hotel’s website were not accessible through any aggregator at all.

Why this matters: Many travelers trust major booking platforms to show the full range of options – but this finding shows that’s not always the case. For hotels and OTAs, it’s crucial to realize that relying solely on aggregator visibility may not capture the full customer demand or present the hotel’s full inventory correctly.

Why this may happen:

- Inventory control: Hotels often reserve some room categories, promotional offers, or flexible rate plans for direct booking to encourage customers to avoid third-party commissions.

- Channel-specific promotions: Special perks (like free upgrades or breakfast) are sometimes only offered through direct booking to incentivize loyalty.

- Data synchronization gaps: Not all platforms update in real time. If a hotel updates availability or pricing, it may not immediately reflect on all third-party sites.

- Contract limitations: Some aggregator platforms may not have access to the hotel's full inventory based on contractual terms.

What it means for hotels and OTAs: Hotels that want to optimize revenue and customer satisfaction need to ensure their most competitive offers are either clearly visible across platforms – or strongly promoted on their own websites. Mismatches can frustrate customers or lead to lost bookings when better deals appear elsewhere.

Finding: Hotels Lose Visibility – And Potential Guests – If Platforms Don’t Offer Listings for Certain Regions

What we observed: When testing from different geolocations, we found that some hotel listings were missing or unavailable on certain booking platforms depending on the user’s simulated location. For example, a hotel might appear on a platform when browsing from Germany but not when browsing from Japan or Israel. Sometimes, even when the hotel chain was present globally, specific properties didn’t show up in the search results at all for users in certain regions.

Why this matters: When a listing is missing, users assume the hotel is fully booked, unavailable, or simply not an option – and move on to competitors. Hotels and OTAs risk losing direct and indirect revenue simply because their inventory isn't visible to potential customers based on their region. In competitive markets like Barcelona, every missed opportunity can have a real impact on occupancy rates and revenue per available room.

Why this may happen:

- Platform geotargeting policies: Some platforms customize which hotels they display based on perceived local demand or strategic partnerships.

- Regional distribution agreements: Certain hotels may not have contracts covering all global regions with every aggregator.

- Technical setup issues: Content delivery networks (CDNs) or platform settings can sometimes accidentally restrict visibility to specific geolocations.

- Localized pricing or promotions: Some hotels intentionally limit certain offers or inventory to specific markets.

What it means for hotels and OTAs: Ensuring global visibility is key, especially for major tourist destinations. Hotels need to actively audit how and where their listings appear across platforms and geographies. Regular checks – or third-party monitoring services – can help spot hidden visibility gaps before they impact booking numbers.

How Infatica Powers Accurate, Scalable Data Collection

Reliable, large-scale data collection – especially across multiple geographies and platforms – requires more than just technical expertise. It requires the right infrastructure. Infatica’s global proxy network played a critical role in powering this pricing analysis:

- Flexible geo-targeting: Using Infatica’s residential and datacenter proxies, we simulated real user access from multiple locations (Germany, the U.S., Israel, and Japan). This allowed us to capture true regional differences in hotel availability and pricing – without the distortion of centralized IP detection.

- Scalability and stability: Infatica’s network is built to handle millions of requests daily with minimal downtime. This ensured that the data was collected consistently across all platforms, with near 100% uptime, and delivered on time for analysis.

- GDPR and ISO/IEC 27001:2022 compliance: Data privacy and security are core to Infatica’s operations. Our proxy network and data handling processes fully comply with GDPR standards and are ISO/IEC 27001:2022 certified, ensuring that data collection practices meet the highest global benchmarks for security and ethical use.

- High-quality residential IPs: Infatica’s ethical residential proxies – sourced with end-user consent – helped bypass bot detection mechanisms, CAPTCHAs, and region-blocking barriers that typically hinder scraping efforts. This provided clean, accurate, and unbiased datasets, critical for drawing reliable insights.

The result? Accurate, region-specific hotel pricing and availability data – collected at scale, with full regulatory compliance, and minimal operational friction. Whether you’re monitoring global e-commerce prices, hotel availability, or airline ticket trends, Infatica provides the infrastructure you need to collect the right data, the right way.